Add your title

Combine large, bold images with the beautifully crafted words of your story.

Working Hard for the Taxpayer

In today’s world, every dollar counts. Lone Star College understands the need to balance between offering top-rate educational opportunities, state-of-the-art facilities and safe environments for students and ensuring it remains fiscally responsible to the taxpayer.

That’s why the LSC Board of Trustees voted to approve lowering the LSC fiscal year 2024 tax rate during its October meeting. The new tax rate not only saves homeowners money but also allows LSC to pay off $30.25 million of debt early, saving the taxpayers $9.7 million in interest payments. LSC already enjoys one of the lowest tax rates among Texas community colleges and has lowered or maintained the same rate since 2015.

“Lone Star College takes its fiduciary responsibility very seriously and is proud to be in the position to offer this relief,” said Michael Stoma, LSC Board of Trustees chair. “The board appreciates the citizens who attend our meetings and participate in the Public Comment to share their concerns with us. We do listen and are ready to make changes when necessary.”

LSC already enjoys one of the lowest tax rates among Texas community colleges and has lowered or maintained the same rate since 2015.

Approved for the Community

The 88th Texas Legislature passed House Bill 8 to allocate $683 million in additional funding for 50 community colleges across the state. Signed into law by Governor Greg Abbott, two-year institutions like LSC will receive dollars based on the number of degrees and certificates awarded.

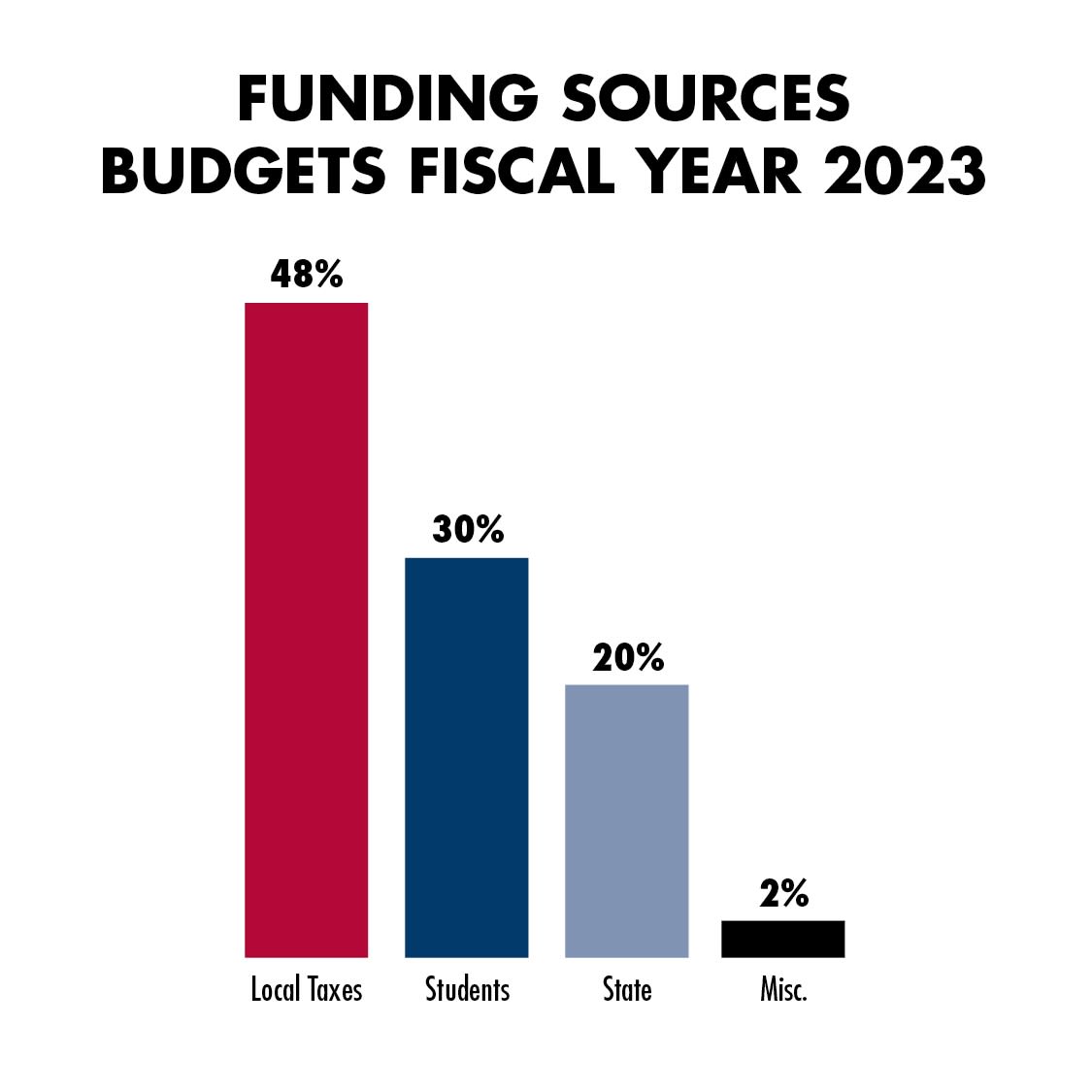

“State funding accounts for 20% of Lone Star College’s financial support,” said Valerie Kot, LSC associate vice chancellor, Reporting and Operations. “The new law will increase the amount of money that Lone Star College will receive from the state.”

Texas House Bill 8 also created the Financial Aid for Swift Transfer program, which allows economically disadvantaged high school students to enroll in dual credit courses for free. This initiative will grow LSC’s Dual Credit program, which currently serves 24,415 students from 11 independent school districts located in LSC’s service area.

“In distributing funds through House Bill 8, the state will also look at how many students complete and transfer at least 15 hours to a four-year university, enroll in dual credit classes or take a required course for an academic or workforce program,” said Kot.

LoneStar.edu/Administration-Finance